Professional Tax in Maharashtra

admin

28-04-2021

As per the Maharashtra State

Tax on Professions, Trades, Callings and Employment Act, 1975, people (both

freelance and employed) are subject to a professional tax. This state-level tax

is imposed on income earned through various means, including profession, trade,

calling, or employment.

The professional tax is structured based

on income slabs, meaning the amount payable varies according to the

individual's earnings. Whether you're self-employed or working as an employee

within an organization, this tax applies to your income.

Currently, the maximum tax that can be levied is capped at Rs. 2500 per

year, providing a clear limit on the financial burden one might face.

Understanding these details helps individuals plan their finances better while

ensuring compliance with state regulations. However, so as to pay the

profession tax, one must get associate degree Enrolment

Certificate. The act provides a provision to levy a penalty if any

entity that is vulnerable to pay the profession tax

fails to get the enrolment certificate.

In order to create the registration method for the profession

tax, a hassle-free expertise,

the regime has created the whole method out

there on-line.

How to Enroll Maharashtra Profession Tax?

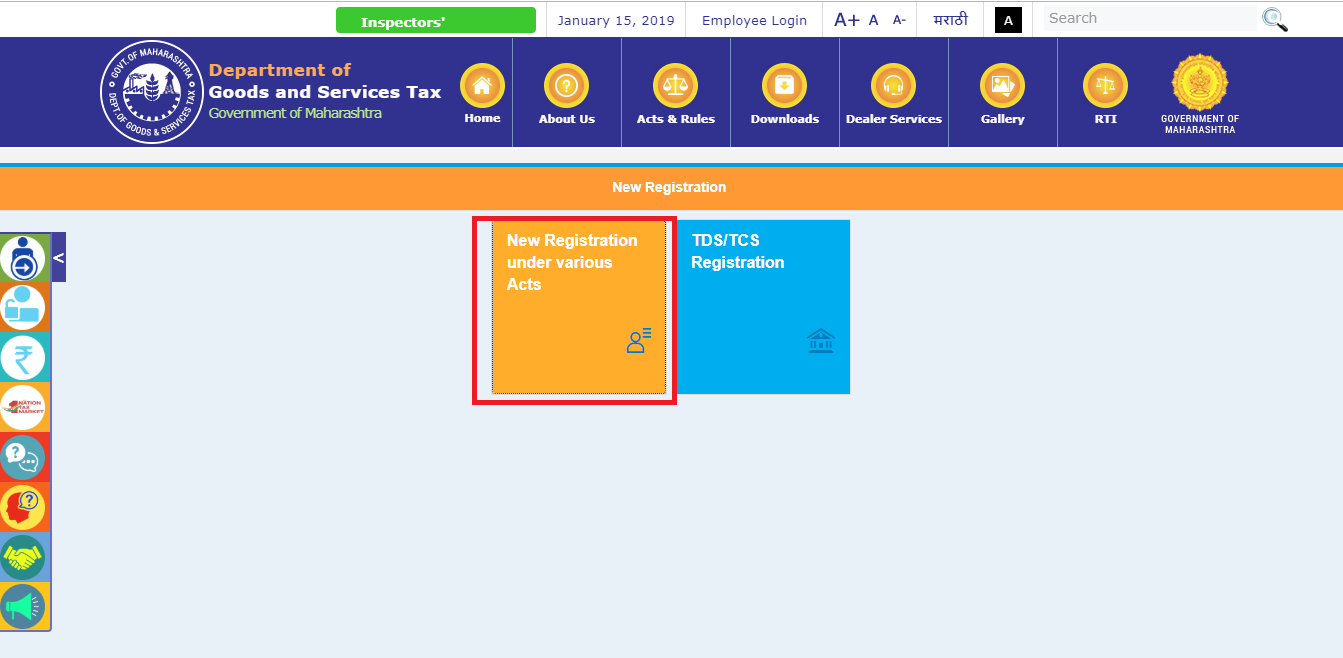

3. Now, select ‘New

Registration Under Various Acts’

4. Click on ‘New Dealer’

if you are doing not have any active registration

certificates underneath any of the acts administered by MSTD and

click on on ‘Next’.

5. Please enter your PAN or TAN variety as applicable.

6. A temporary activation link are sent to your email id. Click thereon link and log in exploitation the word sent to your registered mobile variety. Once verified, new login id and word are sent to your registered email id.

7. Please move to Home Page once more.

8. Click on ‘Log certain e-Services’ then click on ‘Vat and allied acts’.

9. Please enter the user

credentials to reset your password. Once you have reset your password, please

click on ‘Continue’

10. Please click on ‘Registration’

and then on ‘New Registration’.

11. Select The Maharashtra State Tax on Profession, Trades, Callings and

Employments Act, 1975 (PTEC) tab from the list and click on on ‘Next’.

12. Form II are displayed on your screen. Please fill within

the extra details needed in kind II just like the variety of the individual (individual/company), individual details, entry range, number etc. Now, click on ‘Next’.

13. Now, you wish to supply your address details and click on on ‘Next’. After that, please enter details associated

with your house of business like address and get

in touch with details, electricity bill details and IGR (property)

details. once more click on ‘Next’.

14. Here, you're needed to supply the bank details. You’ll a checking

account by filling within the necessary details.

15. Now you wish to enter your entry no. and sub-entry no. as per the

applicable class. so as to seek out your class, please click on Annexure I. Then click on ‘Next’.

16. Kindly create a self-declaration regarding the truthfulness of the knowledge provided by checking right the declaration box and

click on on ‘Next’.

17. Now, you wish to transfer a scanned copy of supporting documents as

needed and click on on ‘Next’.

18. Acknowledgement would be generated. Congratulations! You’ve

got with success registered for the Profession Tax payment. You’ll be assigned a distinctive enrollment certificate.

For more information please reach out us at

i[email protected]